18+ poor man's covered call calculator

The Poor Mans Covered Call strategy used LEAPS options as stock replacements resulting in higher returns on capital. The first step in the poor mans covered call strategy is to choose an appropriate LEAPS contract to replace buying 100 shares of BA.

Poor Man S Covered Call Introduction And Real Trade Analysis By The Potato Trader Medium

Browse thousands of brands and find deals on poor man covered call at Amazon.

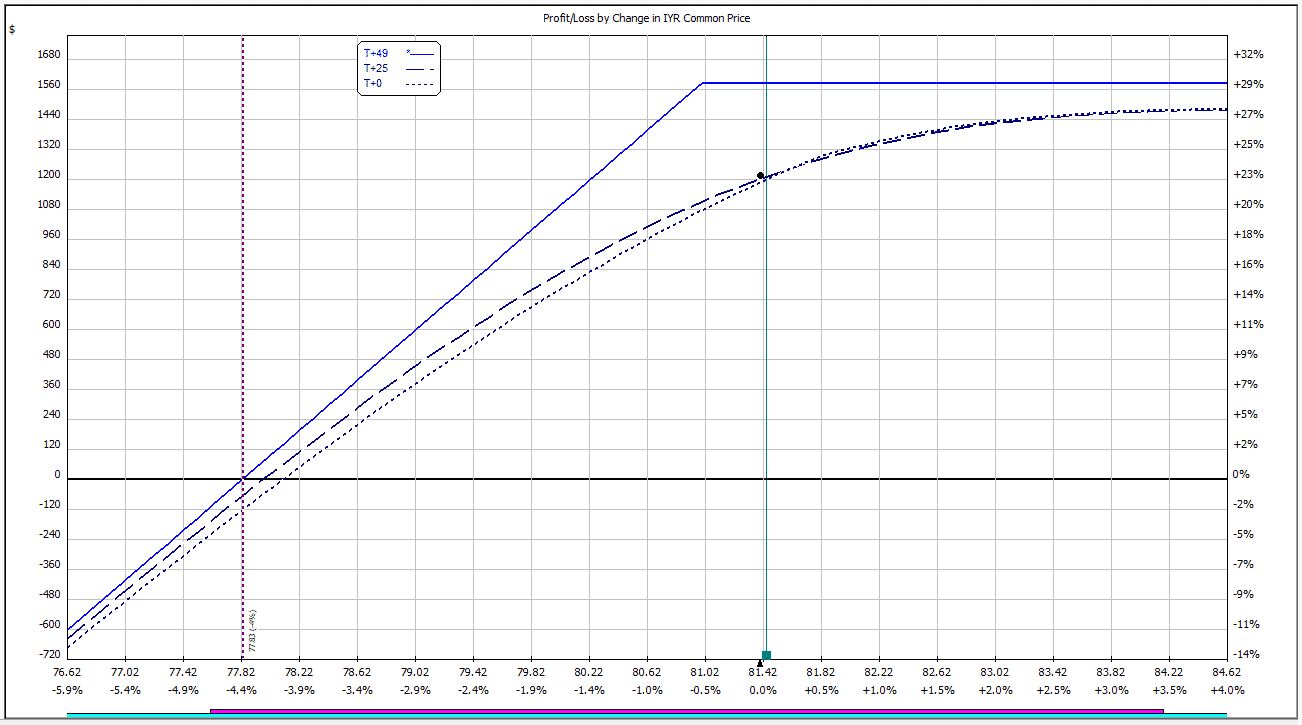

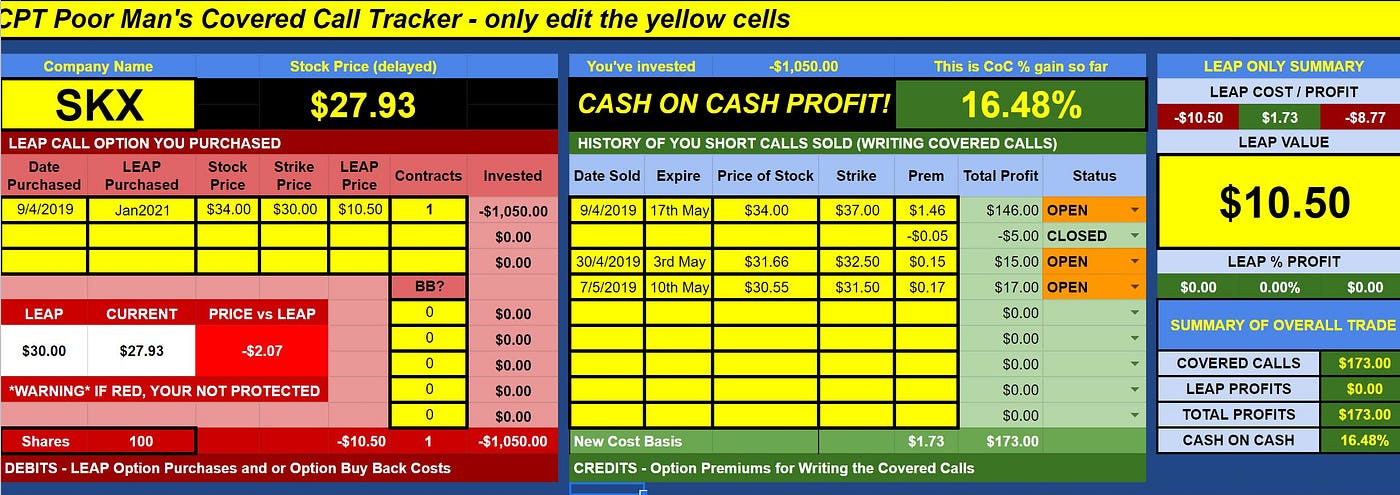

. Overview DEFINITION A poor mans covered call is a long call diagonal debit spread that is used to replicate a covered call position. This is a covered call writing-like strategy where a deep in-the-money LEAPS option is purchased instead of a stock or ETF exchange. Poor mans covered call calculator.

A poor mans covered call is a long call diagonal debit spread that is used to replicate a covered call position. Ad 1 Online Trading Education. Bull call spread calculator.

The poor mans covered call strategy PMCC also known as a synthetic covered call is a call diagonal spread used to replicate the structure of a traditional covered call. Safe Consistent Income Strategy. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

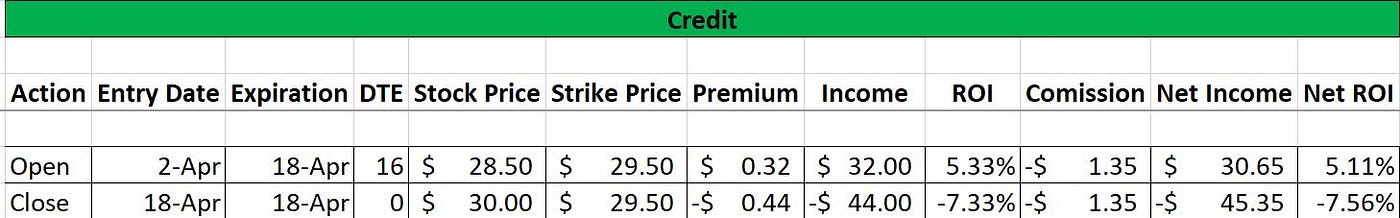

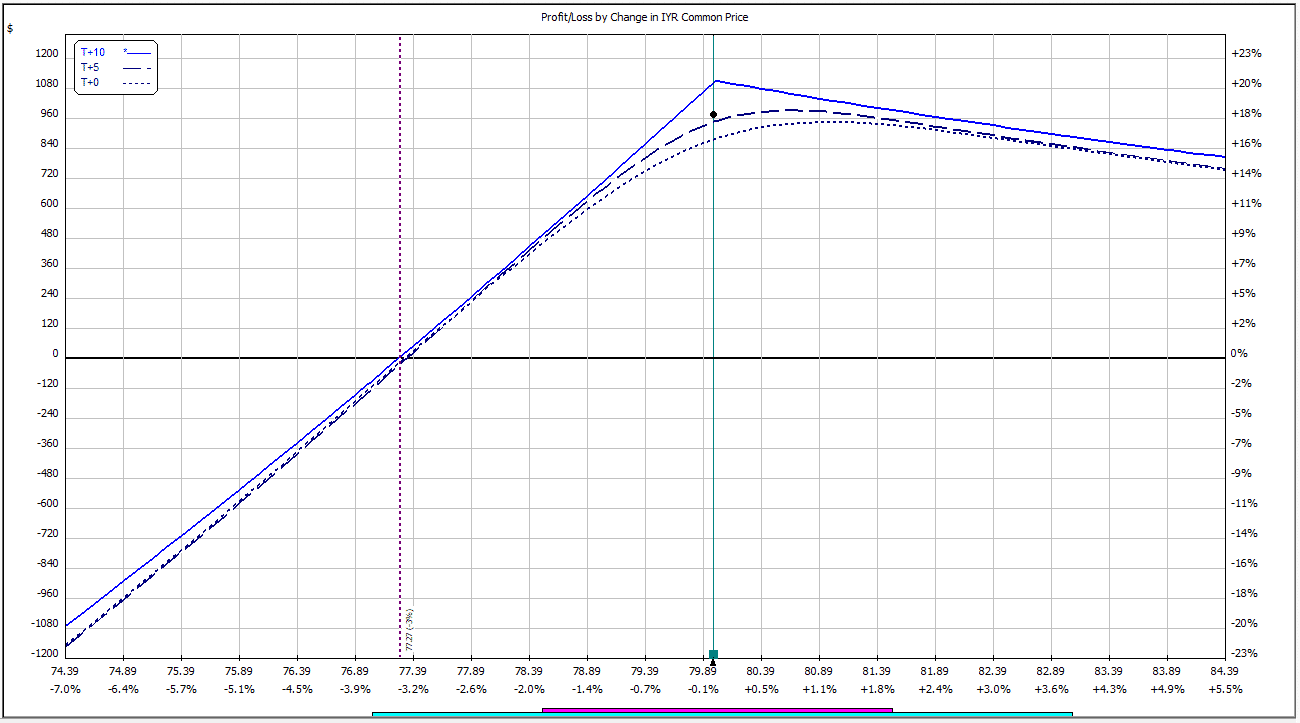

The breakeven price of the stock for your poor mans covered call is typically. In this article we will look at the covered call strategy. PMCC Trade Cost Cost of Long Call - Credit from Short Call If we constructed a normal covered call wed.

Call spread calculator. There are pros and cons to this strategy. Free strategy guide reveals how to start trading options on a shoestring budget.

Ad Discover new arrivals latest discounts in poor man covered call from your favorite brands. Lets say I buy a 90 ITM call and sell a 100 otm call. If we were to buy BA shares at 32998 per.

A covered call strategy involves being long on a stock and short on a call. Build Your Future With a Firm that has 85 Years of Investment Experience. What is the poor mans covered call.

Ad See the options trade you can make today with just 270. I understand that I can use my long call. Strike price of long option Initial cash outlay So in our example above your break even point.

The long call option at. Call debit spread calculator. Covered Call Income Generation Strategy.

The strategy gets its name from the reduced risk and capital requirement relative. Poor Mans CC Trade. Stock goes up to 105 and I get assigned on my short call and need to buy 100 shares of stock.

Poor Mans CC Trade Cost 2455 2765 outflow 310 inflow. As a result you decide to enter into a poor mans covered call and purchase a June 140 call option and sell a May 155 call option.

The Options Industry Council Oic Covered Call Calculator

Covered Call Calculator New

Covered Call Calculator For Thinkorswim Free Tutorial

What S A Poor Man S Covered Call And How To Calculate It Business Module Hub

Poor Man S Covered Call

Analyzing Leaps For The Poor Man S Covered Call Free Webinar Registration Link The Blue Collar Investor

Poor Man S Covered Call

Covered Call Calculator For Thinkorswim Free Tutorial

Covered Call Calculator For Thinkorswim Free Tutorial

Good Candidates For Poor Mans Covered Call Youtube

The Best Covered Call Calculator And How To Use It

The Top 25 Affiliate Marketing Websites

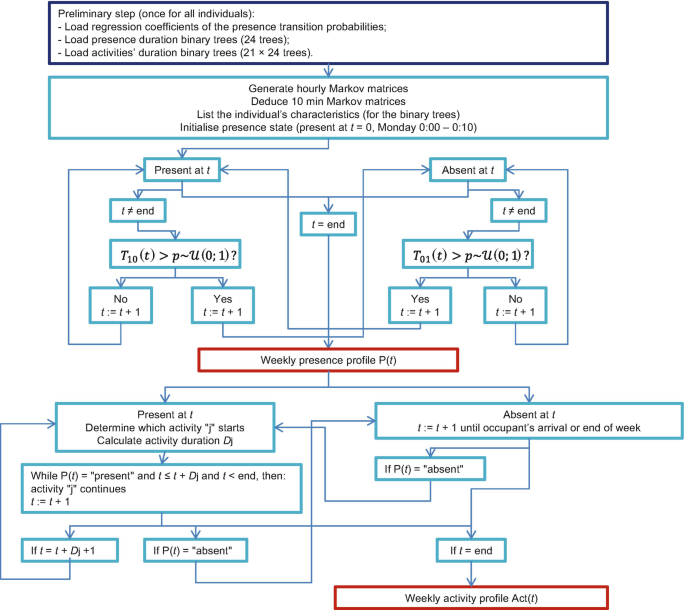

Stochastic Prediction Of Residents Activities And Related Energy Management Springerlink

Covered Call Option Calculator Youtube

Poor Man S Covered Call

Poor Man S Covered Call Introduction And Real Trade Analysis By The Potato Trader Medium

Poor Mans Covered Calls See The Greens